sales tax permit austin texas

Business owners social security number. Sales tax permit austin texas.

How To Register For A Sales Tax Permit In Texas Taxjar

This sales tax is paid to the state quarterly and is submitted along with the appropriate state tax forms.

. They are also pitching a number of plans to increase the state sales tax in the future. Apply for a Sales Tax Permit Online. Recognizes texas insurance licenses AUSTIN Texas FOX 7 Austin Texas Comptroller Glenn Hegar is reminding Texans they will be able to purchase certain items tax-free April 27-29 during the states sales tax holiday.

See Prepayment Discounts Extensions and. Have it in mind that once you receive your Texas sellers permit the state expects you to. Sales Permit Tax ID.

102 rows This dataset includes 700 thousand taxpayers including sales tax and franchise tax. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. Austin in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Austin totaling 2.

Texas has 2176 special sales tax jurisdictions with local. Sales and Use Tax. Texas lawmakers are considering an infusion of 9.

6113 Sales Permit Texas 78748. The name of a business at a particular location. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

For tax rates in other cities see texas sales taxes by city and county. Sales taxpayers who prepay can claim 05 percent for timely filing and paying plus 125 percent for prepaying. Texas offers both a sales and use tax permit and effective October 1 2019 Texas offers a single local tax rate for remote sellers.

Opening a new business my Hays County Click Here to Get Your Sellers Permit Online. MacRobertgsh NiDay 10 Ke Mar Heven. Top Apply For Your Texas Sales Tax Permit Now.

Registering for a Sales Tax Permit in Texas. Resellers Permit Austin Texas own online home business. What do you need to register.

Sales Tax Surcharge on Diesel Equipment. Sell taxable services in Texas. We have all the rules and requirements for obtaining this certificate down and are ready to.

See our publication Taxable Services for more information. Combined with the state sales tax the highest sales tax rate in Texas is 825 in the cities of Houston Dallas San Antonio Austin and El Paso and 106 other cities. Unfortunately trying to figure out where you.

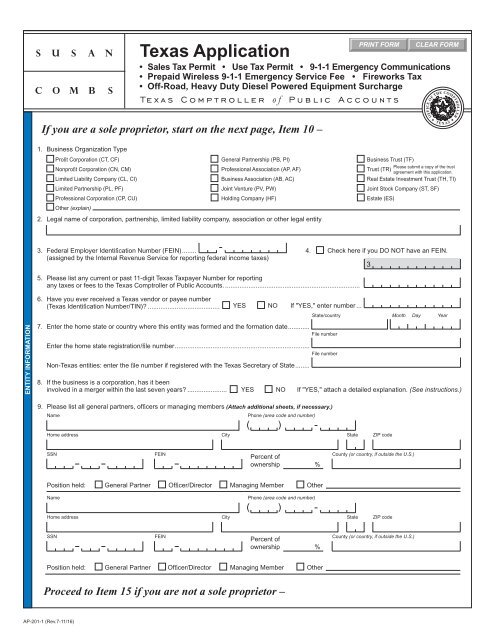

Similarly you can download the application form and mail it to. Get Your Texas Sales Tax Permit Online. Use this application to register for these taxes and fees.

Individuals LLCs corporations partnerships and even businesses whos corporate office is outside of Texas. Sales and Use Tax Applications. Persons registering for an AgTimber Exemption Number to purchase certain items used in the production of agricultural and timber.

This lists the resale permit number company. The proposals include hiking taxes on items such as sweet. Comptroller of Public Accounts.

The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. As a remote seller if you exceed the 500000 safe harbor amount you are required to obtain a permit and begin collecting and remitting use tax on sales to customers in texas beginning no. Independent sales reps of direct sales organizations direct sales organizations are required to collect sales tax from the independent distributors persons requesting a sales tax permit solely for the purpose of purchasing items at wholesale prices.

You sell taxable services in Texas. Texas imposes a 625. Contents Classification system naics code required Sales tax increase Business entity.

All Wholesale Trade Sales businessesentities need a business license and an EIN. Parentslegal guardians may apply for a permit on behalf of a minor. You can find more information about the remote seller option here.

Taxes and Fees Covered by This Permit. AP-201 Texas Application for Sales and Use Tax Permit PDF AP-215 Texas Online Tax Registration Signature Form PDF AP-220 Instructions for Completing Texas Sales and Use Tax Permit Application PDF. Starting my own Hays County Click Here to Get Your Sellers.

Last updated March 2022. You can easily apply for a sales tax permit online through the Comptrollers site here. There is no applicable county tax.

Sales Tax In Austin Texas Question 3467 Friday April 2 2021. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get an Austin Texas Sales Tax Permit. View City Sales Tax Rates.

Lease or rent tangible personal property in Texas. You can find more tax rates and allowances for Austin and Texas in the 2022 Texas Tax Tables. 20194 Resellers Permit Austin Texas 78748.

For the purpose of this blog we will be applying for the standard sales and use permit. You will need to pay an application fee when you apply for a Texas Sales Tax Permit and you will receive your permit 2-3 weeks after filing your application. For tax rates in other cities see Texas sales taxes by city and county.

Retail Trade Hays County Click Here to Get Your Sellers Permit Online. An Austin Texas Sales Tax Permit can only be obtained through an authorized government agency. Taxpayer ID Search FEI Number.

Pick Up Your Permit. Applicants must be at least 18 years of age. About Sales Permit Texas Print Austin TX 78748.

Complete the Texas Sales and Use Tax Resale Certificate when buying from distributors. 911 Surcharge and Fees. There currently is no charge to apply for a Texas sales tax permit.

Sell tangible personal property in Texas. View County Sales Tax Rates. Location Texas sales tax permit.

You must obtain a Texas sales and use tax permit if you are an individual partnership corporation or other legal entity engaged in business in Texas and you. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. Taxpayer ID is an eleven digit number assigned by the Texas Comptroller.

That includes any business or entity type. TX SALES TAX ID SellingBuying Wholesale Trade Sales related itemsmerchandisefood wholesale or retail requires a TX Sales sellers permit. You can print a 825 sales tax table here.

It can be the same or. The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax. Any business in Texas that plans to sell or lease tangible goods or personal property needs a Sales and Use Tax Permit.

How Does Sales Tax. You now have a permit number and are ready to collect sales tax whenever a buyer makes a purchase from your business. Permitted sales taxpayers can claim a discount of 05 percent of the amount of tax timely reported and paid.

Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

Ap 201 Texas Application For Texas Sales And Use Tax Permit

Bar Ama Tex Mex Restaurant Los Angeles Dailycandy Bar Restaurant Interior Bar Restaurant

An Oenophile S Dream Wine Cellar House Dream House

How To Get A Resale Certificate In Texas Startingyourbusiness Com

Ffxiv Diadem Gathering Guide Fishing Monster Locations And Weather Times Digital Trends Gathering Monster Weather

Como Sacar El Sales Tax Permit En Texas Ganar Dinero Por Internet Como Ganar Dinero Texas

Ap 201 Texas Application For Texas Sales And Use Tax Permit

Texas Attorney General Opinion Jm 973 The Portal To Texas History

Do I Need A Seller S Permit For My Texas Business Legalzoom Com

Sunset At Kidepo Valley National Park Http Www Wildwhispersafrica Com Uganda Kidepo Safari African Sunset Sunset Places To Travel

An Oenophile S Dream Wine Cellar House Dream House

Its Template Drivers License State Texas File Photoshop Version 2 You Can Change Name Address Bi Drivers License Id Card Template Birth Certificate Template

Texas Sales Tax Small Business Guide Truic

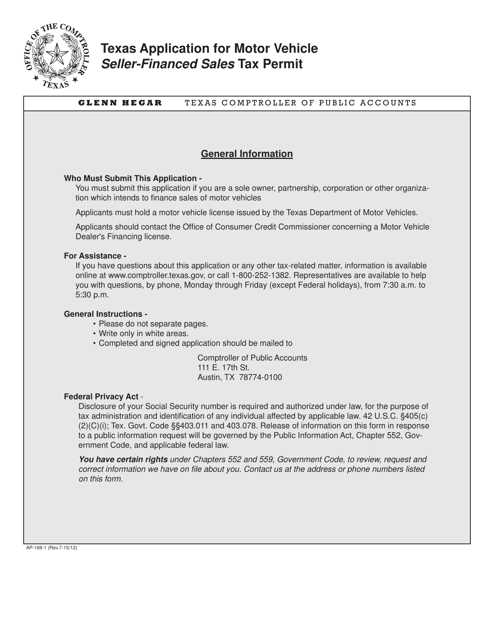

Form Ap 169 Download Fillable Pdf Or Fill Online Texas Application For Motor Vehicle Seller Financed Sales Tax Permit Texas Templateroller

Lexus Dealer Targets Tesla Owners With Cheeky Ad You Ve Had Your Fun Says Austin Dealership Lexus Dealer Lexus Tesla Owner

How To Apply For The Texas Sales Tax Permit 2020 Step By Step Youtube