what is fit tax on paycheck

The percentage method is based on the graduated federal tax rates 0 10 12 22 24 32 35 and 37 for individuals. Social Security is 62 for both employee and employer for a total of 124.

12 Month Pink Monthly Budget Planner Financial Etsy Budget Planner Template Budget Planner Monthly Budget Planner

Both Social Security and Medicare taxes are fixed-rate taxes you withhold from your employees wages and pay on behalf of your employees.

. It is up to a business to estimate how much tax needs to be withheld every pay period. These two taxes aka FICA taxes. The FIT is a form of tax on yearly incomes for businesses individuals and additional lawful entities.

This amount is based on information provided on the employees W-4. FIT taxes are the income taxes that you pay to the federal government. FICA stands for Federal Insurance Contribution Act.

Social Security and Medicare. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee. The amount of income you earn.

10 12 22 24 32 35 and 37. This is the simpler method and it tells you the exact amount of money to withhold based on an employees taxable wages number of allowances marital status and payroll period. If you see the fit deduction listed on your paychecks earning statement it is an acronym for federal income tax.

Pay the FICA tax withholding from all employees and. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Depending on the size of your payroll you must make deposits monthly or semi-weekly.

As an employees salary increases so does his federal income tax rate. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. The major cradle of income for the federal administration is the federal income tax.

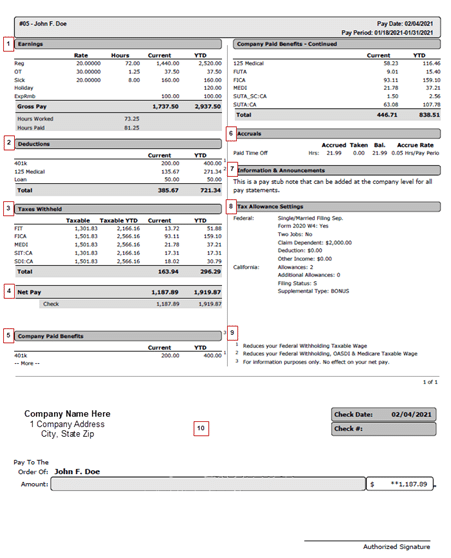

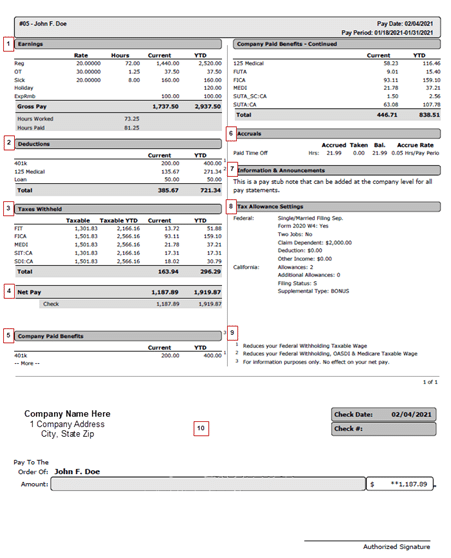

What Is Fit Tax On Paycheck. After you receive Form W-4 from your employee you can use the wage bracket method to calculate his or her federal income tax. Fit stands for Federal Income Tax Withheld.

These are the rates for taxes due. The amount of income tax your employer withholds from your regular pay depends on two things. In a nutshell you see FIT tax on your paycheck as your employer is required to withhold a certain amount of money as federal income tax FIT from your earnings.

Both employers and employees are responsible for payroll taxes. The employee is responsible for this amount and the FIT tax is. FICA taxes are commonly called the payroll tax.

There are seven federal tax brackets for the 2021 tax year. To this effect employers are asked to withhold a. How much is FIT tax.

What is fit tax on paycheck. For help with your withholding you may use the Tax Withholding Estimator. Every individual is required to pay federal income taxes on their taxable earnings that can include wages salaries bonuses tips or others.

It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. Employers withhold FIT taxes from most paychecks along with state and local taxes. Medicare is 145 for both employee and employer totaling a tax of 29.

This tax includes two separate taxes for employees. FIT tax is calculated based on an employees Form W-4. Federal Income Tax or FIT is the amount withheld from an employees paycheck which goes toward their Federal Income Tax liability at the end of the year.

Employers withhold FIT using either a percentage method bracket method or alternative method. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. If you withhold at the single rate or at the lower married rate.

To calculate federal income tax withholding you will need. Income tax generally is computed as the product of a tax rate times the taxable income. This year for instance a single individual who makes 20000 per year is subject to the 12 percent tax bracket.

However they dont include all taxes related to payroll. These amounts are paid by both employees and employers. How to Figure Your Withholding Amount.

Answer 1 of 2. FIT is the amount required by law for employers to withhold from wages to pay taxes. Specifically after each payroll you must Pay the federal income tax withholding from all employees.

All salaries cash gifts wages from business income gambling income employers tips unemployment benefits and bonuses are focused on a tax of federal income. For employees withholding is the amount of federal income tax withheld from your paycheck. The information you give your employer on Form W4.

There are two federal income tax withholding methods for use in 2021. Each allowance you. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

However each state specifies its own tax rates which we will. Pay your half of the FICA tax for all employees. However this doesnt mean 12.

How many withholding allowances you claim. FICA taxes are payroll taxes and they are. Your employer uses the data in your IRS filing sheet to determine how much of your pay to withhold.

Your net income gets calculated by removing all the deductions. FICA taxes consist of Social Security and Medicare taxes. An income tax is a tax imposed on individuals or entities taxpayers in respect of the income or profits earned by them commonly called taxable income.

The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you. The amount you earn. Federal Tax Withheld 2019 carfareme 20192020 from wwwcarfareme.

Your bracket depends on your taxable income and filing status. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. Wage bracket method and percentage method.

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. What is the fit tax rate for 2020. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed Org Word Template Payroll Template Templates

Printable Bi Weekly Budget Printable Colorful Financial Budget Etsy In 2022 Weekly Budget Printable Budget Printables Budgeting

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Understanding Your Paycheck Credit Com

Employee Pay Stub Template Excel Word Apple Numbers Apple Pages Pdf Template Net Invoice Design Templates Words

Different Types Of Payroll Deductions Gusto

Monthly Budget Tracker Schedule Digital Download Etsy Budget Tracker Monthly Budget Budgeting

Free 8 Sample Medical Invoice Templates In Ms Word Pdf Invoice Template Bill Template Medical Billing

A Guide On How To Read Your Pay Stub Accupay Systems

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software

Solved What Is The Purpose Of Extra Withholding Under The State Section Of The Employee Taxes

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Pay Statement Innovative Business Solutions

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time